Basel and the Financial Sector

Hey everyone, at the beginning I would like to welcome you all to my new contribution and hope you all have a week which has brought numerous experiences into your life so far! Today I would like to share something about the financial system and show you what an important role Basel plays in it.

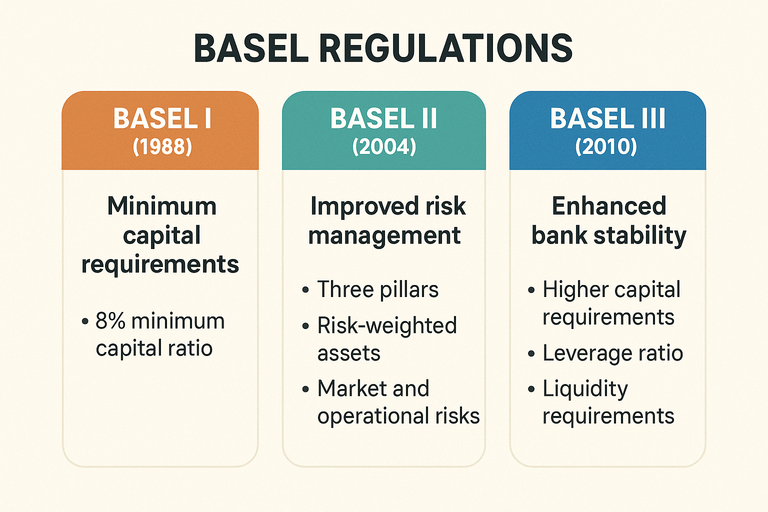

Switzerland is generally known for playing an important role in the financial sector and one of the major cities in this context is the old city of Basel. Unlike other cities which are known for their loose regulations, Basel is not a stock exchange location like London but a central place for the entire system of finance and it can also be described as a kind of node in the middle of this complex system. If there are adaptations to this system, here is the think tank and then these regulations are transferred to the global financial markets and some of the well-known examples are decades-old rules such as Basel I and their successors which were first adopted in Basel and then enforced on a global level.

The Basel framework can also be referred to as international standards for banks, which have the main task of ensuring the stability of the financial system and to achieve this goal, rules are applied that contain different factors like limits or risk factors as well as other important measures. Often these rules that have been drawn up by the Basel Committee are confused with laws, but this is wrong and it is more about standards and the core here is that it's the responsibility of the respective countries themselves to adapt them to laws. In Basel is one of the oldest institutions of the financial sector which has existed for almost 100 years and is also known as Bank for International Settlements or BIS for short.

In order to better describe the task, it's first important to understand that the BIS is, so to speak, a kind of central control centre for central banks worldwide and forms an important platform for the international exchange or cooperation of important positions in the financial sector, which includes the exchange of current news or experiences. It's also a lot about recognising crises and then finding solutions to them and if there are problems with payment transactions in a country, possible solutions are discussed here which have the goal of ensuring stability and it is important to recognise the effect and in some cases to adapt the standards. It can also be said that Basel is especially the capital of banking because of the regulatory aspects and it's an important centrepiece of the global system on which standards for the international central banks are written. In addition, there is also the fact that many banks throughout the area have their location here and these are both national or international players.

Thank you very much for stopping by and I hope you could learn something new and like my post! I captured these pictures with my Sony Alpha 6000 plus 55-210 mm, iPhone 16 and created these Illustrations with the help of AI.

You can check out this post and your own profile on the map. Be part of the Worldmappin Community and join our Discord Channel to get in touch with other travelers, ask questions or just be updated on our latest features.

That was an interesting read. My neurons aren't good at this niche !LOL

It's good to see that you have expertise in many sectors!

Pretty awesome architecture!

lolztoken.com

No one, it happens Autumnatically.

Credit: reddit

@elevator09, I sent you an $LOLZ on behalf of hafiz34

(2/10)

Farm LOLZ tokens when you Delegate Hive or Hive Tokens.

Click to delegate: 10 - 20 - 50 - 100 HP

Now this changed and hope you could learn something new :) I have learned so much in recent years even when I was in Basel. The visit was a great way to learn more about it and I am happy that you appreciate it, there are too many people who begrudge you for things, I recently saw that again.

The BIS and those international banking standards really keep the system stable.

True, the heart of the financial sector

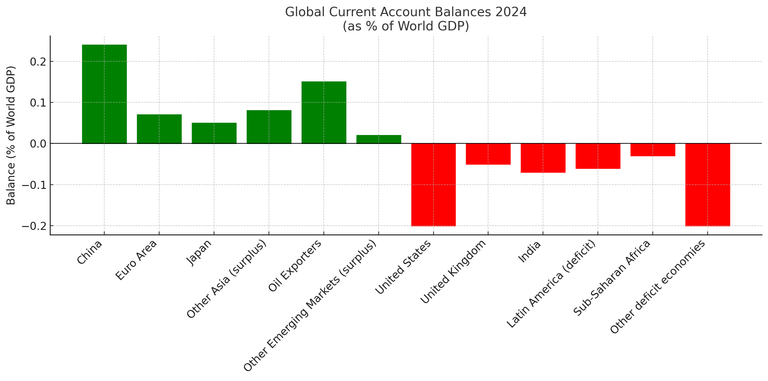

The US debt is out of control and spending needs to stop. Trump has cut back on some waste, but so much more needs to be cut. If all governments would run off of Basel requirements the world would be a much more stable place. In my opinion of course, not that anyone listens or cares...

Awesome post!

!PAKX

View or trade

PAKXtokens.Use !PAKX command if you hold enough balance to call for a @pakx vote on worthy posts! More details available on PAKX Blog.

Thank you so much for your nice feedback and I’m glad to see that you’re also thinking about the topic. In recent weeks, I have also been very concerned with the US debt, which increases by 10 billion dollars a day. The sums to pay off the debts do not come from the real economy but from refinancing, which means that new loans area created to pay the old ones. It’s a sensitive topic, I just made a statistic for you :) USA is paying 2.6 Billion each day to pay the debt, but as mentioned, the funds come from refinancing. There are many things to adjust in this system and to improve economy! Wish you a great week dear @thebighigg

https://x.com/jewellery_all/status/1958252392774013131

I never knew that The USA was in this much debt

That’s crazy…

Where there are problems, there are also solutions. I am glad that you are also interested in the topic, look at the top comment, I have posted a statistic in the conversation with @thebighigg

https://x.com/lee19389/status/1958310854681829633

#hive #posh

It is exactly like this, our country is also running in debt in the same way. To pay off one debt, it takes a loan from another country and then keeps paying interest on it. This is how the world system is running.

Happy to see your interest in this field, just created this statistic about Pakistan for you dear @djbravo

https://x.com/MdParve40521896/status/1958458685216452990

Something needs to be done if not, these debt will continue to actually increase and increase

It is a complex issue. It offers advantages as well as disadvantages..