You Owe You

Are you in debt?

House, car, student, credit card loans?

Total US household debt reached a record $18.20 trillion in the first quarter of 2025. This includes mortgage debt, student loans, auto loans, and credit card debt.

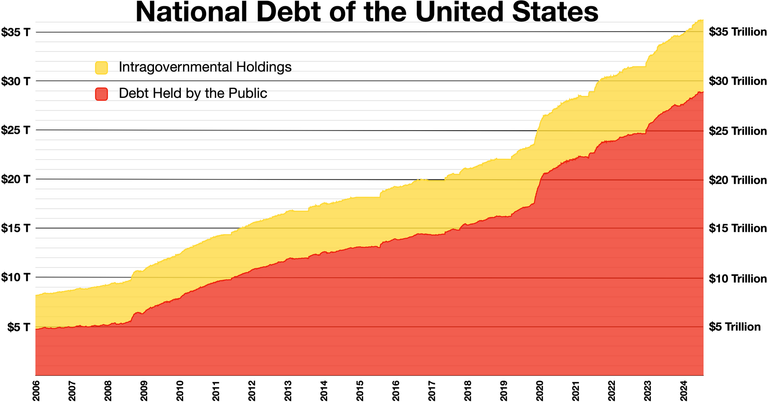

What that means is that if the increase in US governmental debt over the last twelve years was instead spent to pay off the debt of people in the US, every American would be living debt free. No mortgage, no credit card, no car, student debt.

Nothing.

My question is, would that have been a better use for the money spent?

I wonder what would have happened if instead of bailing out the banks in the GFC, they bailed out the people instead. For instance, they could have paid it off by percentage. If a bank needed one billion in bailout money and they had personal loan liabilities of 10 billion, 10 percent would be deducted directly from the outstanding amount of every personal loan account. The banks would get their money from all the loans being paid off, but after that, they wouldn't have that loan amount accruing interest. They would still be saved from immediate collapse. Fast forward and the entirety of those loans could have been paid off by the government years ago.

What would people have done?

I suspect that if people had all their debts paid off, it would be a pretty wild spending spree after that, as people's incomes would all become disposable once again. Investing would sky rocket, consumption would sky rocket, and pretty soon, a lot of people would be in debt again. But, not as many.

Americans seem to have a debt mentality when it comes to personal finance, with a lot of people quite comfortable taking loans for everything they want to buy, so they can have it now. Some of my American friends here tend to do much the same as they would back home - living a bit larger than the average Finn in the same financial position. They have lot's of stuff, but also lots of debt.

The "debt mentality" is what makes the US the largest consumer on earth, because the culture is to spend, whether a private citizen, a corporation, or a government. The largest market on earth, is only possible because of the mounting debt burden. And they just keep expanding it in the hope that when the music stops, there will be such a calamity that they won't have to pay it back - as the nukes fly across the skies.

It is a fragile economy.

The US economic situation is not robust, it is highly fragile. As I have said before, the Rest of the World should not be negotiating with terrorist governments. And I use that term in the sense that the US government are looking to get their way by forcing other countries, including allies, into terrible situations. The RoW should abandon all negotiations with the US, and increase the cost of what they send to the US. Make it so incredibly expensive to buy from the RoW that they will have to start their own manufacturing.

Jobs for Americans!

The problem is though, that the US runs on debt and it is able to do that because of international trade demand. Once that demand for their market stops, the debt model immediately becomes unsustainable. The Us will no longer be able to increase debt to cover expenses, because it will be moving "money" from one pocket to another. A closed off to trade America would see it collapse. However, the RoW will be fine, because it can still do deals with 7.7 billion people with a huge variety of goods and services to choose from. This means that the RoW can increase spending by a couple percent, and it would cover the US. And it would be able to do this, because it will no longer have to pay for the privilege of the US market.

All US companies have to pay their full taxes in the country where it is earned.

All those big beautiful, Fortune 500 companies - suddenly aren't so attractive to investors, are they? It is because of these dodgy accounting practices that they can offer higher returns because they can inflate their earnings, by syphoning value out of the countries where they earn it. Local companies are at a disadvantage to the conglomerates like Microsoft, Amazon, Facebook and Apple - because they have to pay their taxes locally. The large tech companies generate little monetary value within a country, but take a huge amount out.

There are replacements for them.

Essentially, with the current US regime, the best course of action for the RoW is to fork them out of the global economy as much as possible. Ramp up production of anything that comes from the US currently, and find alternative sources where possible. Buy *nothing from the US if possible, and sell them nothing also. It will hurt at first, but once that bandaid is ripped off and the wound heals, the RoW can enjoy unprecedented growth in production and consumer spending.

But, the governments won't do that, because the people within have their interests invested in the US too, and most do not have the balls to go against a military superpower. But, what will the US do, nuke the RoW? Maybe. But that just speeds up the likely result of our mutually assured annihilation anyway. Instead, what they might do is try to go it alone for a while and then realise, they fucking hate the changes to their lives that it brings, and then look to rejoin the RoW as an equal partner, not a regime of tyranny.

Nukes are more likely.

Some people think love makes the world go round. Others think it is taxes. But really, it is debt. The debt cycle is the thing that drives the US power over the RoW, and it is also the thing that forces people to become slaves to activities we don't want to do. Debt is a control mechanism that has been created to keep power in the hands of a few, and as a conceptual control to stop people from taking their power back. But remember,

None of the debt is real.

Taraz

[ Gen1: Hive ]

Be part of the Hive discussion.

- Comment on the topics of the article, and add your perspectives and experiences.

- Read and discuss with others who comment and build your personal network

- Engage well with me and others and put in effort

And you may be rewarded.

Hmmmmmm, I wonder if the RoW would ever consider this boycott kinda, of the usa. It's true that usa has some pretty hefting debt and I doubt that will change..

This post reminds me.. I gotta pay off some debts, too. 😉😎🤙

Debt isn't the way forward to maintain a good and healthy living as this diverts the attention of building a better life for the future to paying debts that you can't give details of the finance used.

Interesting read, makes you wonder how different the world could be if the system had prioritized people over profit.

I don't think the US (as a nation) will ever pay of its debt. Its citizens might pay off their own debts, but the perpetual desires of capitalists for line and number to go up is not compatible with the physical environment in which we find ourselves.

It is unrealistic and perpetual growth is not possible, nor should it be an incentive.

There is such things as having "enough", and "enough" is abundance.

I can only drive one car at a time.

I can only be at one place at a single time.

I can only eat one ice cream cone (reasonably) at a single time.

But a symbol of excess, I don't want to do the mind-math of "how many cigars can a rich man shove in their mouth at a single time?" I imagine its more than one. I don't even know what a cigar costs.

But having multiple yachts? Capsize, you fucks :P

You raise an interesting point about the sustainability of infinite growth. The tension between the current economic model, which requires constant expansion, and the concept of “enough” is one of the great debates of our time. Everyone does what they see fit with their money; the fact that some people own one or more yachts doesn't make them any less of a person.

Have you noticed that in the last few years, there has been an unusually high number of billionaires dying in accidents?

Quality control. Its very important. Easier to do on one yacht or submersible instead of two.

The ocean is a dangerous, unforgiving place.

Debt moves the world... In history we know something about the "false truth".of the global debt. All historiography, written history, and in particular the political and ideological narrative or "official history" is a big lie, constructed a posteriori, by historians, even if they talk about method and objectivity. You can fill a library with examples like the USA debt.

I think, Mr. Tarazkp, that the world is in a re-arrangement of geopolitical powers and this entails chaos and violence, and none of the countries in conflict is innocent, defending their interests. Meanwhile, the "false truth" is imposed and each side creates its own narrative.

By the way, I'm already preparing my month-end (balance sheet) and the must-have, I think it has me in this false truth.🤑

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

I'm with you. People aren't educated enough about money to avoid the same pitfalls. Even when they are, predatory lending has made it far too easy for them to fall back into the same hole. Add to that the consumer mindset you keep writing about and it's an endless cycle that is doomed to fail.

People win the lottery, and still end up back in debt. It is insane. I would like to test my sanity - and win the lottery :)

I'm with you there my friend!

I think isolating the U.S. economically would be difficult to implement right now due to how interconnected the global economy is, but the idea of self-reliance and diversifying trade partners is definitely an important step for every country.

Yes. But it has to be done at some point. Eventually, the slaves have to rebel, right?

But it seems to me that not only the people of one country, but most people around the world are currently in debt. I have seen many who have once taken on debt, constantly getting caught in the trap of more debt.

I'm thankful my mom raised us with a no-debt-mentality, and that my father was always complaining about the debt he had (he got a bad deal at a bank, and will likely be paying of his debt until he dies). I built everything with what I had, which honestly was quite a bit thanks to a previous efforts and some luck.

As soon as debt falls, the whole economic system falls. Debt is just another currency, a shadow-currency so to speak, used not to buy goods, but good-will and favors. And the best part is - you don't even have to spend it. The one that owns the debt can ask many favors, and the debt is still there.

It would be great to see the RoW unite on that, but they're part of the system, too. The ferocious consumerism in the US is easy to criticize, but it keeps the whole system alive, too. Alas, that's what most countries still want. They're scared of the afterwards. And I'm not an economist, so I can't have the most educated opinion on the matter. But I'm more inclined to going cold-turkey than slowly dying from addiction and taking the rest with me.

It is true that multinational corporations use complex tax strategies to minimize their tax burden, a topic of global debate. However, @tarazkp presents this as a purely American conspiracy rather than a feature of modern global capitalism.

The final phrase, “None of the debt is real,” is an ideological statement, not an economic one. While the nature of fiat money and debt can be debated, in the current system, debt has very real consequences for individuals, businesses, and governments. Dismissing it as “not real” is a way of evading the complexity of the problem.

And this is what the US does. It generates its own debt, and then increases that debt by buying the debt of countries that they can then get favour from.

Nope. They want to keep playing the game that fucks the rest of us over.

I don't like debt, it's bad for my nervous system. I like good assets and passive income.

Yeah. Debt only feels okay, when there is far more coming in than going out.

We can stop buying their products and selling them stuff, OR we can stop using dollars entirely. This is why we crypto :)

I think the first thing would be to cut out the trade side - then moving to a new currency is a no brainer for everyone. :)

Debt is really a thing with whom there should be a distance. That's totally unimaginable, the situation which is created. It's actually a thing which just let's you in the game and there's no way out of it, you actually get trapped. Most of people instead have to sell some of these expensive items like gold or something to get out of it but still they fail too...

I have no debt and I don't own anything. It's very difficult to own anything without going into debt. If you're a salaried employee, it's difficult to get anything without taking out a loan or using a credit card. I don't like debt, so I own nothing.

If you own nothing, than you have nothing to lose. It is not a bad position to be in.

I think a population without debt might result in more disposable income, encouraging innovation and entrepreneurship instead of continuing dependence on credit.

After reading twice and meditating a bit, I think your text is more valuable as an example of a radical and polemical point of view than as a reliable source of information or a coherent economic analysis. Your arguments are based on emotion and hyperbole rather than logic and evidence. You should take life slowly, time does not stand still and we become obsolete very quickly.

Would you like a university thesis instead?

Most assertions are speculative opinions unsupported by data. Reducing complex economic and geopolitical issues to simplistic narratives of good guys vs. bad guys (RoW vs. US) is not objectivity. The use of extreme language (‘terrorist’, ‘nukes’) undermines your credibility and distances you from serious debate. There are clear contradictions: you claim that the US economy is fragile because of its global dependence, but its collapse would not harm the rest of the world. I see the discourse as constructed to confirm a strongly anti-US view, not to explore an issue in a balanced way.

Lucky for my partner and I, we've been living debt free now for about 2 years. Well, besides the monthly charge on our credit cards that we pay off in full every month.

But this is not the way to build wealth in America. The system is designed to reward those who take on debt, but only for those who spend it wisely on profit-generating assets. Splinterlands was an easy route for me to send BTC and other cryptos I stacked at huge profits that I didnt want to sell for fear of the tax liability.

However, if and when the ability arises for me to take out bank-secured loans against my BTC without having to sell it for a huge tax penalty... I'm ready for some debt. It will be by far my best way to finally get ahead of the tax code and the banking cabal it works for.

By all means, I hope the RoW strikes back against the US and its new ridiculous trading policies. I can't stand the current administration. Right now, these ICE agents being armed as gestapo forces against Hispanic Americans are in short supply. US offers $45K signing bonus plus 6figure salary to become one of these thug agents kidnapping Hispanics off the streets to throw in detention centers and labor camps.

That $45K signing bonus is more than the entire yearly salary of a new teacher in a dozen US states! How sad this country has become. If the RoW continues to support this country and administration l, I truly fear for the future of the world.

45K?! That sounds like a job foreigners could do! ;D

The RoW is playing politics. That is not the game the US is playing though. If the RoW wants to be civil in trade, they are going to have to break away from the US, because that game is over.

After reading your post and all the comments below, I will take an un-popular opinion. DuceCrypto did mention that "the system is designed to reward those who take on debt, but only those who spend it wisely on profit-generating assets"

That is absolutely correct. There is Good debt and there is Bad debt in USA. The good debt on the macro level is companies borrowing giant amount of money at very cheap rates and that let's American companies scale up and make a lot more money than they would have been able to make without taking on Good debt.

The Good debt on the micro level is people borrowing at really low rates to buy real estate. At least that was for decades, not so sure about it right now. But ever since I came to America in 1996 it worked. In fact it worked so well that despite major setbacks like divorce where I started over from -400K USD in 2006 I was able to become financially independent.

Real estate in USA was basically designed as a foolproof way to build wealth over time. Trump put a big dent into that in his first tax cut law in his first term where he limited mortgage interest, real estate tax and local taxes to only $10,000 per year. And now after rates under 3% created very high prices in real estate with current rates closer to 7% I am not sure real estate is a great buy right now. If prices drop 25-40% from these levels and rates go back down to 4% real estate related debt will once again become a license to print $$$$$$$

The problem is that the majority of people in the US (and the RoW) don't take good debt, as they have bought into the marketing for pleasure. It is on cars that they don't need, and holidays they can't afford, and clothes that don't change them, and all the other consumer crap that they have been encouraged to buy now. Most aren't investors in any sense.

That totally makes sense :) Yeah we only take trips for pleasure and have credit cards that we use to get points and pay off every month. We do have a small loan on BMW at a very low rate of a couple % that doesn't make sense to pay off because we make twice more in CDs right now. Other than that after I sold this last house we don't have any other loans...

It's frightening to me how the entire American fiat financial system normalizes and relies on debt to survive. At this point the only escape from this I can imagine would be a total reset of the economy. You can only begin to fully understand how this affects you when you're on the other side and become debt-free.

That economic reset is coming again. The problem is, we keep building what we know, and what we know doesn't work.