Up and... Down

I usually have a busy Friday and look forward to Saturday to take it slower. Little did I know I'll be waking up to a nice surprise on Hive.

As I went through my morning routine at the laptop, which includes tasks both Hive and non-Hive related, at some point I reached the step in my routine to power up my daily HIVE. Although I don't always check the price of HIVE when I do it, somehow this time it popped into my eyes in the wallet that it was significantly up.

That deserved further investigation to see if any of my sell orders got triggered. And yep, they did. All my sell ordered below 30c got executed and, what was even better, the price was already below my completed order with the lowest price. That meant that I could buy back HIVE at any time and have a profit on all sell orders. And I did that, even though the price went further down from that point.

People could say that I am impatient on the way down and I don't wait for the full movement down. Analyzing after the fact, that is true, and I often do that, not maximizing the potential profit.

But I guess I have a decently long trading experience (now rather inactive), to know that in the past I waited too long wanting to increase the profit, and ended up with the market turning and losing compared to the time where I could have acted and, while not maximizing profit, ending up with more than with what I made by being greedy (sometimes a loss, other times a lower profit).

Some time ago, I would have regretted if I pulled the trigger early and could have made more by taking advantage of volatility or trend better. Nowadays, I am always happy when I make a profit (+123 HIVE is nice!), especially when I see I have chosen my limit orders price levels well, and when I make a profit while ending up with the same coin so that I can take advantage of future price pumps.

Speaking of them (price pumps), they are getting more frequent again... for those interested. But if you want to take advantage of them, unless you are awake and paying attention when they happen, the only way to do it effectively is to have limit orders. If you don't have experience using them and technical analysis, you can try with small amounts until you understand how this works.

While there is some level of predictability in the Hive pumps by Upbit whales, no one who isn't an insider can know for sure when they come or how high will the price reach (the latter may be an unknown to the initiators themselves, to some degree). That's why limit orders kept updated regularly are necessary. For example, I could "feel" the previous small pump coming last Sunday (or around that time), but nothing signaled me this one coming, which was bigger. Without limit orders, I would have missed it entirely.

What about you? Any interest in these intra-day price swings?

Posted Using INLEO

Congratulations on your trade win …was good you used the limit order cos staying and monitoring those trades can be a lot

More wins

Without limit orders I would have missed this one for sure. Thanks!

Koreans are back!

Yes, they are!

+123 HIVE winning is interesting. Anyway, I was happy to see the price of $HIVE rise today and thought it would break the upper resistance and go higher. Anyway, I hope its price will increase very soon.

It did go through a few tough resistances, but didn't stay above any of them on the way down. The fact crypto was red today didn't help to keep HIVE from falling all the way down, but that is one of the types of markets Koreans prefer for doing their thing.

A profit is a profit, doesn't matter what could have been... What's that upbit whales?

These Hive pumps are usually started from Upbit, most likely by some (liquid) Hive whales over there.

Congratulations on your trade profit. It is still okay that you took advantage of the opportunity

Thanks. Yes, while the profit could have been higher, I learned not to regret not waiting until the show is over.

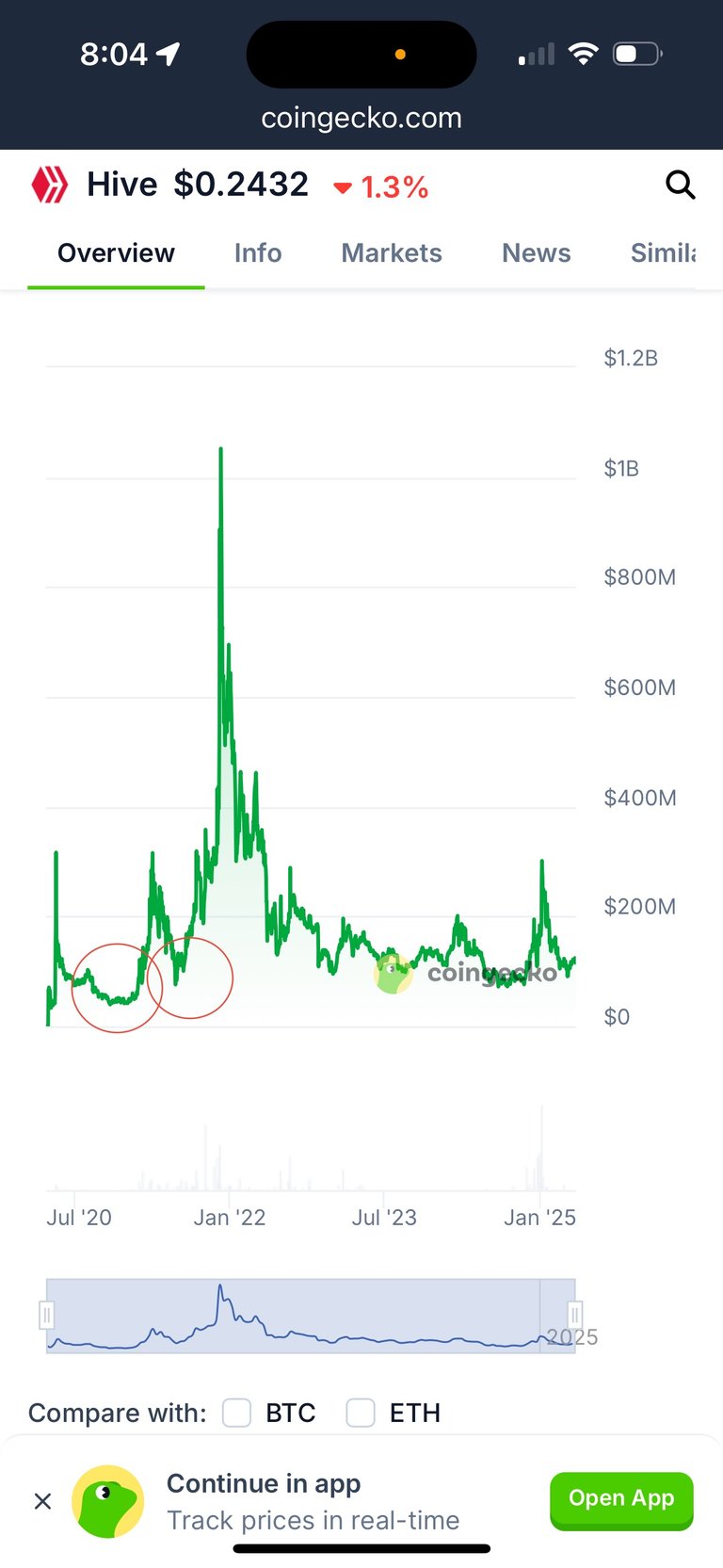

After a pump we always go lower than where we started, so just eyeballing the chart we should see .24 cents or less. Anything can happen, but that is the pattern I noticed in the past.

Not always, but it seems to be a pattern lately (and usually). Yep, could have been a higher profit had I waited...

You’re right, it didn’t happen two times in history, but that second one i just noticed looks like it actually did it... hmm 🧐

I thought there were a few more. But maybe I remembered the ones from the alt season, where Upbit whales weren't driving the show anymore.

Altera or Conclave Arcana could be important catalysts to help us past the January peak. I am generally optimistic for the future.

Well... Altera needs more rollouts. Once true defi features are out, we will see an increased interest in it and VSC.

Conclave Arcana needs an end of the presale with some fireworks to light some fire into people and have something to promote for the beginning of the general sale.

Sure, things like the campaign mode and the mobile apps will help onboarding and retaining new users a lot, compared to the present/past days. Also, the fact that they can play most of the game without a paywall almost at the beginning. All these things and everything the Splinterlands team has done this year should matter in various degrees to the success of the new set and the marketing campaign.

The Academy section is the biggest unsung hero in all of this IMHO. It saves players from having to read the Whitepaper, support articles or go through tutorials.

Anything related to VSC should fall behind the estimated timelines based on the past performance we have seen. I wish they would get more funding and hire more developers. The same could be said about Koinos.

Yes! Something like that would be very helpful on Hive interfaces too. Also the "campaign mode", i.e. gamification for new users.

Looks like it...

Luckily with this recent proposal we have a lot more funding to work with. We've already hired one new person, with more on the way. It should accelerate development a lot over the next 2-3 months.

This is music to my ears! Once you have Altera working and bringing in revenue, you should be able to ask for even more funding to hire more developers. I only have 16,613 HP, but I will fully support you with it. I'm looking forward to see the project out of beta.

Best of Luck!

haha. Will consider that for our next proposal in a little under 1 year.

That's really some good profit! I think setting realistic price targets, in terms of limit orders is what's a bit hard for me. It isn't unlike trying to be greedy to get more profit or being fearful and getting way less profit.

For Hive things aren't so complicated since when big price changes happen (due to Upbit pumps), unless we are in an alt season, the price almost always corrects to previous levels. So, it's a matter of not being greedy so that the limit orders get reached and you will likely make a profit during these volatile days, if you wait for the price to come back down below your sell point(s), to be able to buy back.

Right. I'm presuming the Upbit pumps have some form of pattern to them, in terms of how high the price pump reaches, percentage wise?

If that's the case, then it will be much easier to place the limit orders somewhere beneath those levels and wait for the price to retrace back down for a buyback.

I'm presuming the Upbit pumps have some form of pattern to them, in terms of how high the price pump reaches, percentage wise?

Nope. That I don't think they can predict either, since they have a reaction from the market.

You can place your orders up from the current price (and update them regularly). Something like a minimum of 20% for the lowest one should be ok, unless there are some levels where you anticipate higher resistance and you would place orders at a lower price differential. Always orders should be in ascending order of amounts when selling (meaning starting with the lower amounts at the lower prices and higher amounts at the higher prices).

You can tweak these thresholds depending how active you are in updating the limits and how interested in catching smaller pumps. However, the tighter the interval, the higher the chance of ending up on the losing side if the price keeps going up instead of returning to previous levels.

Sure. I understand it better now. Thank you very much! Great insight on placing ascending order of amounts when selling and the risk of ending on the losing side with tighter trading intervals. Didn't know such a strategy exist.

Nice job on the profits. I am wondering if I should be putting in those orders as well to catch up on those pumps. It could be risky if prices don't go back down, but technically, I got most of the Hive when the price was around 20 cents. So it might mean some extra HBD to hold.

I do put in some very small orders where I practically take out a fixed profit in HIVE (which I keep), and the HBD that was initially traded I move to HBD savings after such a trade gets executed. I did it this time too. Sure, this is potential profit forfeited from the future appreciation of HIVE I could have bought with that HBD (compared to the interest on HBD), that's why I do it with (very) small amounts. But it is guaranteed profit on the way up of HIVE (around 25% usually), plus the interest on HBD.

Nice win.

I sold 3k on binance and bought back for 110 hive profit. Same as that i could have made 200 if i waited to this morning but i was worried about a secondary pump as their is a long list of buy orders on the exchange that could pump it hard at any time.

Do you use the binance earn for hive at all? when the price pumps the APR jumps and is still over 30% today? I made another 45 hive just from the interest and same today if it holds for a while.

Thanks and back at you for taking profit as well!

No, I don't use Binance Earn, despite the enticing interest. I still have a trust issue keeping funds on a CEX.

No one can predict the "full movement" down. Most of the time it's either you end up getting it wrong. It's best to just take the profit and wait for another swing to play the same game. That's a decent chunk of profit you've made. Could easily be worth 220$ at 2$ Hive. I think some of these back and forth trading is an underrated way to earn decent Hive before the pump.

I think so too. It's its tedious and repetitive nature and some work to keep things well-organized that probably keeps more people from doing it more. Plus the risk that it might go wrong and end up losing instead of winning. But it seems pretty safe with Hive pumps, at least for my acceptable level of risk.

For me, I've lost more times than I've won and the problem is always when you try to either sell too quick or sell too late, either way you're probably going to get burned if you're not careful. I think a 2 to 3$ price point will justify the whole stress.

I got burned a couple of times too, but lately I seem to have a better handle on them. I ended up in smaller or bigger profit in all Hive trades I entered this year at the end of the day. But it is true, you never know when this streak ends...

Well I like to think we'll get a nicer rally in the summer and it'll all pay off. Unfortunately for me, I got burned in all except the one I did a few days ago.

That would be nice! I hope we will, at least until June.

Hello gadrian!

It's nice to let you know that your article will take 11th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by keithtaylor

You receive 🎖 0.7 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 653 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART